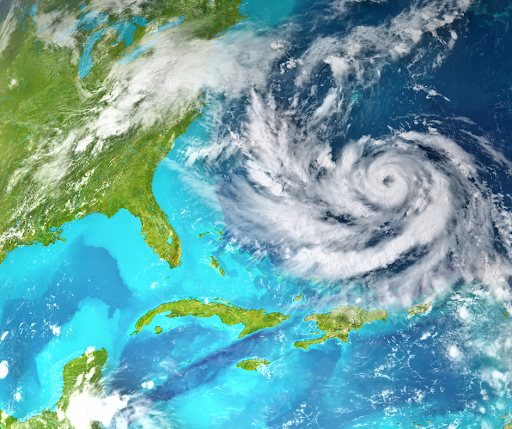

Shielding your business from the storm: Hurricane prevention and insurance strategies

For business owners in hurricane-prone regions, protecting their operations from the destructive forces of these storms should be a priority. Taking proactive measures to prepare for hurricanes and having the right insurance strategies in place can fortify your business against potential damages. In this article, we will explore hurricane prevention measures and insurance strategies that can help shield your business from the destructive forces of these powerful storms.

Creating a Disaster Preparedness Plan:

Developing a comprehensive disaster preparedness plan is essential to ensure the safety of your employees and the continuity of your business operations during and after a hurricane. Outline evacuation procedures, emergency contact information, and communication protocols. Back up important data and documents regularly and store them securely off-site or in the cloud. Establish alternative locations or remote work arrangements to facilitate business continuity. Conduct drills and train employees on emergency procedures. Having a well-defined plan can minimize confusion, respond effectively to emergencies, and protect your business’s assets and reputation.

Tailored your insurance coverage:

When it comes to insurance, one size does not fit all. Having the right insurance coverage is a fundamental aspect of protecting your business from hurricane-related risks. The right business insurance policy includes coverage for windstorms and water damage caused by hurricanes. Review the policy’s limits and deductibles to ensure they align with your business’s needs and potential financial exposure. Additionally, consider business interruption insurance, which can provide coverage for lost income and ongoing expenses during the recovery period. It is essential to review and update your insurance coverage regularly to account for any changes in your business operations or property value.

Business Continuity Planning:

In the aftermath of a hurricane, the ability to quickly resume business operations is vital. Have a plan in place to assess damages, contact insurance providers promptly, and initiate the claims process. Identify essential personnel and establish communication protocols to ensure everyone is informed and accounted for. Back up important data and documents to off-site or cloud storage to protect against potential physical damage. Establish alternative locations or remote working arrangements to enable employees to continue their duties. By planning ahead, you can reduce downtime, serve your customers, and expedite the recovery process, ultimately safeguarding your business’s reputation and financial stability.

As a business owner, safeguarding your enterprise from the devastating impact of hurricanes requires a proactive approach. By implementing physical risk mitigation measures, securing comprehensive insurance coverage, and collaborating with insurance professionals, you can shield your business from the storm.

Ready to protect your business? Contact us! At AIR Insurance, we are ready to help you build a custom plan that fits your needs with our “360º Insurance Guidance”. For more information, call +52 55 4444 6043 or send us an email at info@air.com.mx

The information in this article is subject to the terms and conditions applicable at the time of writing. If you have any questions about the current applicability of this information, please contact an AIR Insurance Brokers advisor.